1. Track Your Expenses Regularly

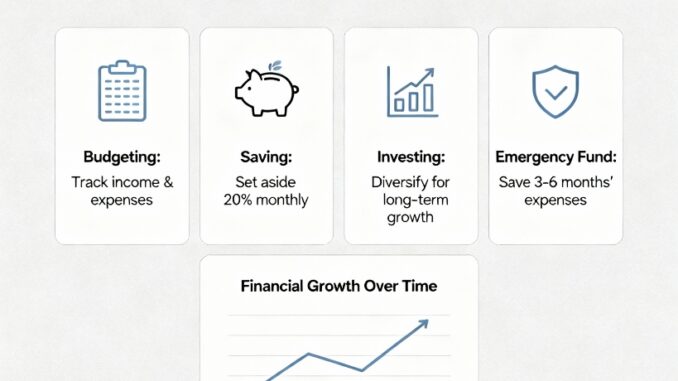

The first step toward achieving financial stability is understanding where your money goes. By tracking your expenses, you uncover spending patterns that reveal both your strengths and weaknesses. Use finance apps or simple spreadsheets to record daily purchases. Knowing how much you spend on food, entertainment, or subscriptions helps you identify areas to cut back. Awareness is the foundation of financial control.

2. Create and Stick to a Budget

Once you’re aware of your spending, develop a realistic budget that aligns with your financial goals. Whether you follow the 50/30/20 rule—allocating 50% to needs, 30% to wants, and 20% to savings—or customize your own structure, consistency matters most. Revisit your budget monthly to adjust for lifestyle changes or unexpected expenses. A well-managed budget prevents overspending and promotes discipline.

3. Build an Emergency Fund

Life is unpredictable, and an emergency fund protects you from financial shocks such as job loss, medical bills, or urgent car repairs. Aim to save at least three to six months of living expenses in a separate, easily accessible account. Start small if necessary, and automate transfers to ensure consistency. Having this backup fund offers peace of mind and prevents reliance on credit cards or loans during life’s surprises.

4. Save Before You Spend

Instead of saving what’s left after spending, practice paying yourself first. Automate your savings so a portion of your income goes directly into savings or investments each month before you start spending. This approach reinforces discipline and ensures you’re consistently building toward financial goals without temptation. Over time, small, automated contributions compound significantly.

5. Manage Debt Wisely

Debt isn’t inherently bad, but unmanageable debt can derail your future. Prioritize paying off high-interest loans such as credit cards first while maintaining minimum payments on other debts. Consider strategies like the snowball method (paying off smallest debts first) or the avalanche method (focusing on highest-interest debts). Always aim to borrow responsibly and avoid unnecessary liabilities.

6. Invest for the Long Term

Saving money helps, but investing allows your wealth to grow faster than inflation. Begin by understanding investment basics—stocks, bonds, index funds, or real estate. Contribute regularly, even with small amounts, to benefit from compound growth. Long-term investing relies on consistency, not timing the market. Diversifying your portfolio also reduces risk and ensures balanced returns over time.

7. Continue Learning About Personal Finance

Financial literacy is a lifelong skill. The more you learn about money, the better your decisions will be. Read books, attend financial webinars, and follow reputable experts who teach practical wealth-building strategies. Staying informed helps you adapt to economic changes, take advantage of new financial tools, and avoid scams or poor investment choices.

8. Set Clear Financial Goals

Without clear goals, managing money can feel directionless. Define short-, medium-, and long-term goals that reflect your priorities—whether buying a home, funding education, or retiring comfortably. Quantify and set timelines for each goal. For instance, you might aim to save $10,000 for an emergency fund within a year. Goals give your money purpose, helping you stay motivated even when progress feels slow.

9. Protect Your Assets and Income

Financial security isn’t just about earning and saving—it’s also about protecting what you’ve built. Secure adequate insurance coverage for health, life, home, and vehicles. Consider disability insurance if your income depends on physical work. Proper coverage minimizes risk in case of unforeseen events that could otherwise cause major setbacks. Review your insurance policies annually to ensure they still meet your needs.

10. Review and Adjust Periodically

Personal finance is not a “set it and forget it” process. Circumstances change—income fluctuates, markets move, and personal goals evolve. Schedule regular reviews of your budget, debt levels, and investment performance at least twice a year. Adjust your strategies when necessary to stay aligned with your objectives. Constant refinement ensures you continue progressing toward financial freedom.

Bonus Tip: Practice Gratitude and Avoid Lifestyle Inflation

Every financial success, no matter how small, deserves recognition. Celebrate progress but resist the urge to spend more simply because you earn more. Lifestyle inflation—upgrading spending habits as your income rises—can silently erode wealth. Practicing gratitude keeps your priorities clear and strengthens your long-term mindset. Real financial growth comes from balance, not excess.

Building a Future of Financial Freedom

Good financial habits aren’t built overnight; they’re crafted through daily discipline and mindful decision-making. Start small—track your expenses, save a little, invest thoughtfully—and let time work its compounding magic. As your habits strengthen, your money starts working for you instead of the other way around. The earlier you start, the greater your potential for financial independence and peace of mind.