With inflation continuing to affect households across Myanmar, managing daily expenses has become increasingly difficult for families, entrepreneurs, and young professionals alike. Traditional budgeting methods often fail in a volatile economy—where food, fuel, and housing costs can change rapidly. This challenge makes Zero-Based Budgeting (ZBB) one of the most practical tools for financial stability.

Unlike traditional budgeting, where you base spending on previous months, zero-based budgeting starts from scratch each month. Every kyat you earn is purposefully assigned—to expenses, savings, or debt payments—so that your total income minus your total allocations equals zero. The goal is simple: to consciously decide where every coin goes before it’s spent.

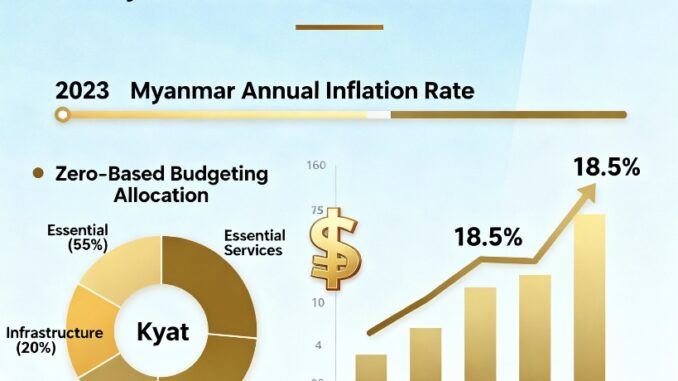

Why Zero-Based Budgeting Fits Myanmar’s Economic Reality

Myanmar’s inflation environment—driven by rising import costs, unstable exchange rates, and disrupted supply chains—requires flexible yet intentional financial planning. Zero-based budgeting forces you to re-evaluate your spending patterns monthly, adapting to inflation and price instability.

- Adapts Quickly: ZBB allows adjustments with every price increase or income fluctuation.

- Helps Prioritize Essentials: Food, utilities, and transportation get allocated first, avoiding shortfalls.

- Supports Cash Management: In a cash-based society like Myanmar, ZBB ensures every kyat is accounted for.

- Encourages Savings: Even small savings become deliberate actions, not afterthoughts.

Step-by-Step Zero-Based Budgeting Exercises for Myanmar

1. Determine Your Monthly Income

List all sources of monthly income—from salary, freelance work, remittances, or small business sales. Inflation may affect the value of your income, so note the true purchasing power rather than just the amount.

For example, if you earn 500,000 MMK per month, remember that rising food and transport costs may effectively reduce the living value of that total.

2. Categorize and List Every Expense

Create a list of all expenses based on your lifestyle and needs. Typical categories for Myanmar households include:

- Food and groceries (rice, oil, eggs, vegetables)

- Transportation (daily commute, fuel, taxis, ride-hailing apps)

- Utilities (electricity, water, and phone top-ups)

- Education (school fees, courses, stationery)

- Healthcare (medicine, doctor visits)

- Rent or mortgage

- Savings and emergency fund

- Donations and charity (a cultural priority in Myanmar)

3. Give Every Kyat a Purpose

Once you’ve calculated income and expenses, assign every kyat to a specific task. If your expenses exceed income, re-balance until the budget totals zero. Cut non-essential categories before touching essentials or savings. Zero-based budgeting requires decisions—not habits.

“You work for every kyat, so every kyat should work for you.”

4. Track Daily Spending

To make ZBB effective, record what you actually spend. You don’t need digital tools—simple paper journals or free apps like Money Lover or MEB Pay are sufficient. Track expenses across key categories weekly. This feedback helps you identify where inflation bites hardest and where adjustments are needed.

5. Conduct Monthly Reviews

At the end of each month, compare your actual expenses with your planned amounts. Adjust next month’s allocations to reflect new prices or income changes. The repeat process keeps your budget current, agile, and realistic in Myanmar’s fast-changing markets.

Practical Exercise Examples

Exercise 1: The “Price Awareness Audit”

Spend one week noting prices of essential goods from your local market. Track rice, oil, eggs, and onions—items whose prices often fluctuate due to supply and fuel rates. By knowing exact trends, you can anticipate cost increases and adjust allocations early.

Exercise 2: The “Cash Envelope Approach”

Label envelopes for each spending category—food, transportation, utilities, and others. Place the exact monthly cash allocation in each. Pay directly from those envelopes. When it’s empty, you’ve reached your limit. This method keeps spending tangible and disciplined, particularly effective where digital banking is limited.

Exercise 3: The “10% Savings Challenge”

Set aside 10% of your income before allocating other expenses. Even small amounts add resilience against emergencies. Consider local savings options such as microfinance institutions or trusted community funds if traditional banks feel inaccessible.

Dealing with Inflation Shock

Inflation in Myanmar—often double digits yearly—creates emotional and financial stress. Zero-based budgeting offers psychological clarity during uncertain times. Instead of reacting to price hikes, you respond strategically because you know your numbers.

- Identify Elastic Expenses: Entertainment, dining out, and new devices should flex downward when food costs rise.

- Use Substitutes: Replace high-cost goods (imported snacks, branded toiletries) with local alternatives.

- Increase Income Streams: Take small gigs or online work to boost inflows and sustain balance.

Digital Tools Supporting Zero-Based Budgeting in Myanmar

Although digital finance adoption remains limited, several platforms can support personal budgeting efforts:

- Mytel Pay and KBZPay: Track transactions and analyze spending patterns monthly.

- Money Manager App: Helps visualize where each kyat goes under predefined categories.

- Google Sheets Templates: Free spreadsheets allow custom ZBB setups accessible in Burmese.

Benefits of Practicing Zero-Based Budgeting

When applied consistently, zero-based budgeting transforms financial behavior across income levels. Its most powerful impacts include:

- Clarity: Know exactly what every purchase costs you.

- Discipline: Reduce impulsive spending through accountability.

- Resilience: Build savings that protect against market shocks.

- Empowerment: Make informed choices under inflation pressure.

Common Mistakes to Avoid

- Failing to track daily spending; ZBB cannot work without follow-up.

- Overlooking small expenses like mobile top-ups—they add up fast.

- Relying on outdated prices; inflation requires updated data every month.

- Skipping emergency savings; this breaks long-term security goals.

Conclusion: Making Every Kyat Count

Zero-based budgeting isn’t just a finance technique—it’s a mindset change urgently needed in Myanmar’s inflation environment. It aligns with traditional values of prudence, self-reliance, and discipline while offering practical defenses against financial instability.

In today’s Myanmar, where uncertainty defines the economy, every household and business can benefit from assigning every kyat a mission. Whether you’re a student paying rent in Yangon or a family selling goods in Mandalay’s markets, zero-based budgeting offers a stable pathway toward financial control and peace of mind.